Alzheimer’s Early Detection

by Jennie Yoo, BS | July 12, 2018

Executive Summary

While the AD biomarker diagnostic market currently faces many barriers to clinical adoption due to lack of insurance testing coverage and biomarkers based on anti-amyloid hypothesis, AD biomarkers such as tau-PET AD biomarkers and neuroinflammatory biomarkers aiming for the companion diagnostic market, patient stratification, and/or personalized treatments show promise in reaching the clinic in the near future.

- While the pursuit of early diagnosis of AD through biomarkers and emerging new technology seems more promising than drug discovery of new AD drug targets, the AD biomarker diagnostic market currently faces many barriers to clinical adoption.

- Barriers to clinical adoption include high cost, lack of standardization and specificity, and lack of longitudinal clinical studies.

- In the meantime, market entry strategies such as companion diagnostics and partnerships with pharma seem to be the growing trend.

- Low success in AD therapeutics in addition to more public awareness and increased governmental funding has created a paradigm shift towards early diagnosis of AD.

- With more longitudinal clinical studies indicating proven reliability and standardization over the next few years, AD biomarkers have the potential to be adopted into clinical practice as a stand-alone AD diagnostic.

Part 1: AD drug development has not seen a major success since 2003

AD is a growing problem with the exact pathophysiology still unknown

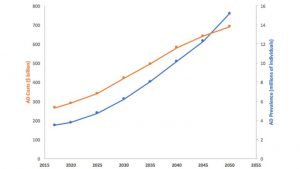

Neurodegenerative diseases such as Alzheimer’s disease (AD), Parkinson’s disease (PD), and amyotrophic lateral sclerosis (ALS) are expected to grow in prevalence due to the increasing size of the aging population. AD is the most expensive disease in the U.S. with direct costs estimated at $570B by 2050 (a 335% increase from 2012), with 33% of those costs covered by Medicare and Medicaid (Figure 1). The prevalence of AD is expected to reach 13.8 million adults in the U.S. and over 130 million adults worldwide by 2050. While the exact pathogenesis of AD is still unclear, the leading hypothesis has historically been that neurodegeneration in AD is caused by the increased presence and/or decreased clearance of amyloid β-peptide (Aβ) [1]. In recent years, the amyloid hypothesis has been increasingly disproven, giving way to more alternative hypotheses of pathogenesis and therapeutic pathways such as stemming ApoE4 pathogenicity [2], controlling errant glucose metabolism and lipid production/trafficking, and modulating the immune system to reduce oxidative stress. The rise of alternative hypotheses may yield more FDA successes.

Source data: Alzheimer’s Association, 2012

Figure 1. Alzheimer’s Prevalence and Costs to Medicare and Medicaid

AD drug development has had recent high profile failures and lack of new therapies

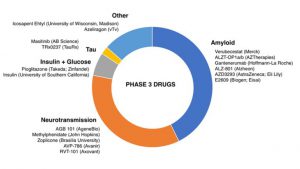

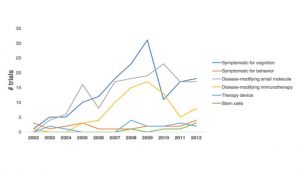

Cholinesterase inhibitors (donepizil, galantamine, and rivastigmine) and an NDMA receptor antagonist (memantine) are the only currently available treatments for cognition and global functioning. These drugs only treat disease symptoms, however and do not slow onset of the disease. A novel AD treatment has not passed FDA approval since 2003 with most recent phase III high-profile failures including Axovant Biosciences Ltd. with intepirdine paired with Aricept in September 2017 and Eli Lilly & Co. with solanezumab in November 2017. The current AD drug development pipeline breakdown by mechanism of action are detailed in Figure 2 [3]. Despite $566 million in federal funding dedicated to Alzheimer’s research, the overall success rate for FDA approval is 0.4%, among the lowest for any therapeutic area, similar to oncology and cardiovascular disease indications [4,5]. Factors contributing to the low success rate for AD drugs include incomplete understanding of AD pathophysiology, lack of predictive validity of animal models, and emergence of unacceptable side effect profiles. The FDA has recognized this and proposed new guidelines released in February 2018 to recruit early patient populations for clinical trials and use of biomarkers for drugs aimed at earlier-stage disease which will result in new therapeutic targets and treatments not previously possible.

Source data: ResearchersAgainstAlzheimer’s (RA2), 2017

Source data: JL Cummings et. al., Alzheimer’s Research & Therapy, 2014

Figure 2. AD Drug Development Pipeline Breakdown by Mechanism of Action

Part 2: AD biomarkers have yet to be integrated into routine clinical care

There is evidence of a paradigm shift towards early diagnosis and treatment choice.

Early diagnosis provides patients the opportunity to enroll in clinical trials earlier and treat other reversible comorbidities such as cerebrovascular conditions. Patients are able to actively participate in future planning and minimize potential hazards. In addition, managed care organizations can reduce healthcare expenditures by increasing early diagnosis and establish care plans [6]. To aid with this, the G0505 Cognitive Impairment Care Planning billing code in January 2017 incentivizes providers in early detection efforts with multidimensional assessments for cognition, function and safety, medication reconciliation, and patient caregiver needs. Low public awareness in addition to fear, stigma, and misperceptions about AD from both patients and providers are barriers to early diagnosis. A recent survey found that 59% of respondents believed that AD is a typical part of aging with 40% believing that AD is not fatal. Since patients do not readily ask providers about cognitive decline, there is a need for a standardized, cost-effective routine primary care screening for AD in adults over 65.

AD biomarkers are not yet recommended for routine diagnostic purposes and are not covered by most insurance plans.

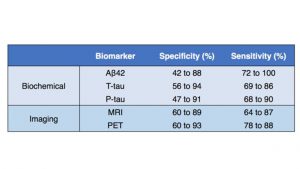

As biochemical changes occur before AD symptoms, AD biomarkers through CSF and PET imaging have been investigated for early diagnosis with varying results (Figure 3) [7]. Establishment of a baseline in the general population without mild cognitive impairment (MCI) and/or AD, predictive value, and cost of PET imaging have limited the utility of PET imaging AD biomarkers. The lack of clinical significance, standardization, universal availability, and validation through longitudinal studies have further limited the utility of AD biomarkers as stand-alone diagnostic tools. The use of AD biomarkers is currently limited to primarily investigational studies and clinical trials for entry diagnostic criterions for both symptomatic and pre-symptomatic AD and measuring pharmacological outcomes. There is an emerging market in companion diagnostics and personalized medicine as we learn more about AD to stratify patients who would benefit from both specific therapies and certain theranostics, which combine diagnostic and therapeutic activity in a single molecule.

Source data: AD Henriques et. al., Experimental Gerontology, 2018.

Figure 3. AD Biomarkers

Part 3: The AD biomarker market is highly fragmented

Peripheral blood AD biomarkers are the new goal.

CSF biomarkers laboratory tests are already commercially available, including ADmark Alzheimer’s Evaluation by Athena Diagnostics incorporating ApoE genotype, Phopho-Tau/Total-Tau/Aβ42 CSF analysis with 95% sensitivity and 60% specificity. However, newer technologies particularly using peripheral blood AD biomarkers have been showing potential in this space due to noninvasive testing and ease of access. Integrated Diagnostics, founded in 2005 with $95.2M, recently raised $6.1M in Series-C financing for detection of early stage lung cancer through liquid biopsy with 97% sensitivity and 44% sensitivity with goals to enter AD next. Another area of development in the AD blood assay market is spectroscopy. C2N Diagnostics from Washington University School of Medicine in St. Louis is commercializing its SILK assay platform reporting a 95% specificity and 75% sensitivity as well as an exclusive license agreement with AbbVie in 2015 for its tau protein assay.

In addition to PET AD biomarkers, the eye-imaging space has been showing promise as a noninvasive screening tool.

In the PET biomarker imaging space, the three FDA approved amyloid agents were developed by large pharma: F18-florbetapir (Amyvid) by Avid Pharmaceuticals/Eli Lilly & Co. in 2012, F18-flutemetamol (Vizamyl) by GE Healthcare in 2013, F18-florbetaben (Neuraceq) by Piramel Imaging in 2014. The IDEAS Study recently reported changes medical management in 67.8% of MCI patients and 65.9% of dementia patients with amyloid-PET results. Dr. Aisling Chaney, a Postdoctoral Research Fellow in the Molecular Imaging Program at Stanford University, comments “This is huge for the field as it not only highlights the difficulties associated with diagnosis based entirely on clinical symptoms, but importantly it demonstrates the additive value of amyloid-PET imaging in terms of diagnosis and disease management” Dr. Chaney further states that amyloid-PET will be hugely impactful as a part of the inclusion/exclusion criteria for participants in clinical trials of new potentially disease-modifying therapies to ensure the correct patient populations are selected. Next-generation tau-PET tracers are gaining more traction as neurofibrillary tangle burden is thought to reflect AD severity more accurately than amyloid burden. None of these are intended to diagnose AD as a stand-alone test or replace existing diagnostic tests, but are used mainly in clinical trials to monitor drug response and aid in prognosis.

Rather than competing within the PET AD diagnostic space, imaging start-ups have found niches within this market particularly in the eye-imaging space. Cognoptix, based in Acton, Mass. and founded in 2001, raised $15M in Series-D financing for its SAPPHIRE II system which measures Aβ protein in the supranuclear region of the eye and has a research collaboration with Merck & Co. Similarly, NeuroVision Imaging LLC founded in 2010 with a group of researchers from Cedars-Sinai Medical Center looks for Aβ protein in the retina and are expanding their partnership and nonexclusive license agreement with Janssen R&D division to aid in their clinical research trials.

Other emerging technologies in AD include use of machine learning and AI and software and pursuing alternative AD hypotheses for prevention and treatment.

There is a role for technology incorporating machine learning and AI in speeding up drug discovery and/or predicting AD. A London-based start-up, BenevolentAI, founded in 2013 uses machine learning to accelerate biomedical discoveries through better target selection and signed a $747.8M deal in 2014 with a unnamed U.S. pharma company for two novel targets for AD. Similarly, Verge Genomics, founded in 2015 out of Y Combinator with $4M in seed funding, uses AI to map interactions among genes in neurological disease to look for known drugs that target those genes. Darmiyan, a San Francisco-based startup founded in 2014 and graduate of Y Combinator with $3.1M in seed funding, has developed an MRI-analyzing software to detect cell abnormalities at a microscopic level and is currently working with Amgen and Pfizer, among other pharma companies. This follows the prevalent trend of machline learning in lead optimization.

Given the decline of the amyloid hypothesis, companies are also starting to look into other pathways and targets, with peaking interest in the neuroinflammation. Alector, founded in 2013 and based in San Francisco, California is in Series D with $91M in funding. This company has a immuno-neurological technology platform that targets immune-related genes in microglia to harness the innate immune system in combating AD. Alector recently announced a $225M collaboration with AbbVie in October 2017 to research a portfolio of antibody targets. Meanwhile, Yumanity Therapeutics, developed out of MIT in 2014 with $51M Series A funding, uses a high-throughput, phenotypic screening (uHTS) platform to discover compounds to correct protein misfolding in neurodegenerative diseases including AD, PD, and ALS. Neuro Therpia, founded in 2015 out of Cleveland Clinic with $2.7M in seed funding, has a lead compound, NTRX-07, which targets CB2 receptors on microglia to reduce the expression of inflammatory agents and has shown promise in pre-clinical studies.

Executive Summary

While the AD biomarker diagnostic market currently faces many barriers to clinical adoption due to lack of insurance testing coverage and biomarkers based on anti-amyloid hypothesis, AD biomarkers such as tau-PET AD biomarkers and neuroinflammatory biomarkers aiming for the companion diagnostic market, patient stratification, and/or personalized treatments show promise in reaching the clinic in the near future.

References

-

- Huang Y & Mucke L. Alzheimer mechanisms and therapeutic strategies. Cell. (2012). 148(6):1204-22.

- Hardy J and Selkoe DJ. The amyloid hypothesis of Alzheimer’s DIsease: progress and problems on the road to therapeutics. Science. (2002). 297(5580):353-356.

- Cummings JL, Lee G, Mortsdorf T, Ritter A, and Zhong K. Alzheimer’s disease drug development pipeline: 2017. Alzehimers Dement. (2017). 3(30):367-384.

- Hay M, Thomas Dw, Craighead JL, Economides C, Rosethal J. Clinical development success rates for investigational drugs. Nat Biotechnol. (2014). 32:40-51.

- Cummings JL, Morstorf T, Zhong K. Alzheimer’s disease drug-development pipeline: few candidates, frequent failures. Alzheimer’s Research & Therapy. (2014). 6:37.

- Leifer BP. Early diagnosis of Alzheimer’s disease: clinical and economic benefits. J Am Geriatr Soc. (2003). 51(5):S281-8.

- Ritchie C, Smailagic N, Noel-Storr AH, Takwoingi Y, Flicker L, et. al. Plasma and cerebrospinal fluid amyloid beta for the diagnosis of Alzheimer’s disease dementia and other dementias in people with mild cognitive impairment (MCI). Cochrane Database Syst Rev. (2014).